The Monthly Multiple: August 2022

Each month we bring you the best of what we’re reading in industry news & market trend commentary. Sign up here to get this curated news brief delivered directly to your inbox.

On The Up-And-Up?

The first half of 2022 was not a happy time for U.S. stocks. The S&P 500 lost nearly 20% of its value, the classic “60/40 portfolio” came on hard times, and investors were left without a liferaft in a sea of troubling news headlines. The news has been better recently: job growth remains surprisingly robust, inflation has moderated some, and stocks have rebounded. We may not be out of stormy seas yet. History shows several examples of “bear rallies” amid a more prolonged downturn. Markets have responded positively to moderating energy prices and the Fed signaling that it may soften its approach after two significant rate hikes. Both factors could be transitory, however, as we saw with some Fed-speak on Friday.

We hope, of course, that markets remain strong and that the worst is already behind us. The bottom line: we just don’t know how macroeconomic conditions will play out over the coming months, and we may see heightened public market volatility in the near term.

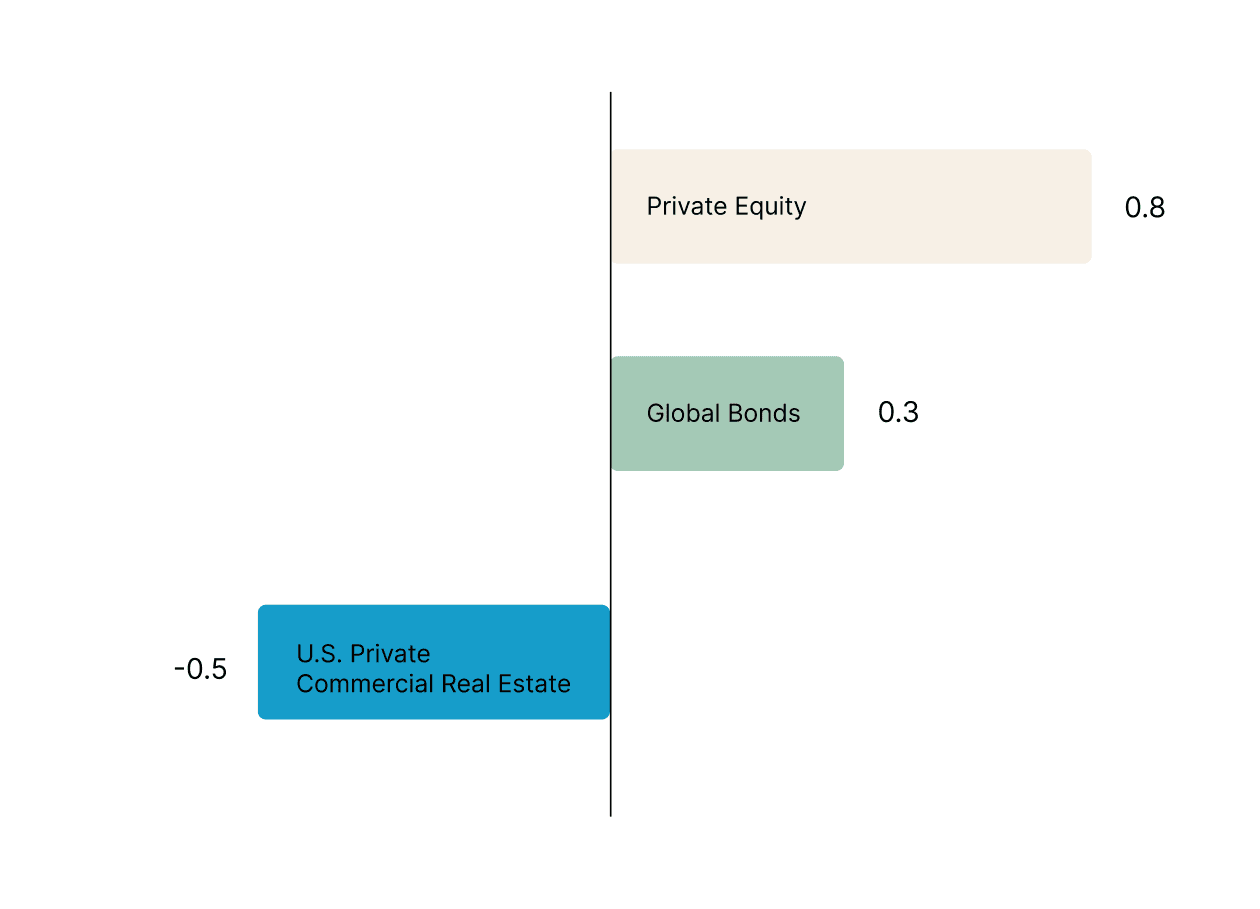

As The Economist recently put it, investors looking to maintain attractive returns and minimize risk will have to “get creative.” Maybe. But maybe not that creative. The solution might be right in front of you or, rather, all around you, built of four walls and a roof. The same article notes that “illiquid assets… are exposed to the same underlying economic forces as stocks and bonds.” Perhaps, but to varying degrees. Between 2009 and 2019, the correlation to global public equities was 0.8 for private equity (highly correlated) but -0.5 for U.S. private commercial real estate. This is another reminder that privately held real estate derives returns from more tangible drivers than traded stocks. Rents and job growth are key macro factors that influence both cash flow and asset values in real estate markets. Both of these durable macroeconomic indicators are in good shape presently.

Correlation To Public Equities: 2009-2019*

A Familiar Alternative

EquityMultiple has delivered a 25% net aggregate return (IRR) on investments realized so far in 2022**, and over $90M distributed to investors. The stock market hopefully continues its recovery throughout the year but, in any case, private real estate investments may provide a compelling alternative in terms of both yield and total return potential.

Further Reading

MSNBC — Fed Minutes Indicate Further Hikes

Bloomberg — Rents in U.S. Rise at Fastest Pace Since 1986

Goldman Sachs — How to Overhaul the Traditional Portfolio When Inflation Surges

*Sources: IPD Global Property Fund Index, MSCI, Bloomberg, Barclays, Cambridge Associates Global Private Equity Index

New From The EquityMultiple Team

EquityMultiple Alternative Investments Guide

A comprehensive look at the alternative investment landscape, and how self-directed investors should approach alts in this moment.

Investor Letter: This Moment

CEO & Co-Founder Charles Clinton’s recent letter to our investors.

How Private Real Estate Serves as a Hedge Against Inflation

A historical perspective on the relative performance of CRE in inflationary periods, and some of the theory.

“Diversification is the only free lunch in finance.” — Dr. Harry Markowitz |

| *Past performance is no guarantee of future results. Aggregate return figures for these investor cohorts were derived by first calculating the dollar-weighted average return of each investor’s portfolio across all fully realized EquityMultiple investments as of 3/21/22, then calculating the mean, standard deviation, and coefficient of variance for each cohort. |

Was this content useful?

We'd like to hear from you. Your feedback will help us provide new material that is useful to you.